Content articles

Finance institutions have a tendency to deserve proof cash to ensure the particular borrowers may pay the money they owe. But, the diagnosis process is much more hard pertaining to borrowers that will are home-used.

Normally, financial institutions need to watch existing income taxes and begin put in statements in order to prove which you have regular, secure cash. On the other hand, the banks most certainly can choose from other types regarding consent including funds and begin losses assertions as well as duplicates involving lodged assessments.

one. Income taxes

When you’re individually, there isn’t any the luxury of the best wages with P-2s to ensure your cash, which will make it will more challenging to apply for credits. Yet, you’ll probably still be able to demonstrate your cash by providing income tax, existing down payment assertions and other forms of sheets.

1000s of finance institutions deserve evidence of funds at borrowers earlier approving your ex mortgage makes use of. For the reason that they would like to make certain that a borrower most certainly get to spend the woman’s fiscal to stop defaulting at your ex move forward expenditures. This can be a little much easier to an employee of your support in order to show proof money by providing the girl employer’s pay out stubs, which can be simple to demonstrate with period.

For a person that is really a free lance as well as freelance specialist, the task is actually more complicated. Along with downpayment statements, the finance institutions also order decade involving taxes and initiate taxes transcripts to make sure that your own cash. Finance institutions usually think about a people altered income and start your ex net to learn whether or not they are a great applicant as being a bank loan.

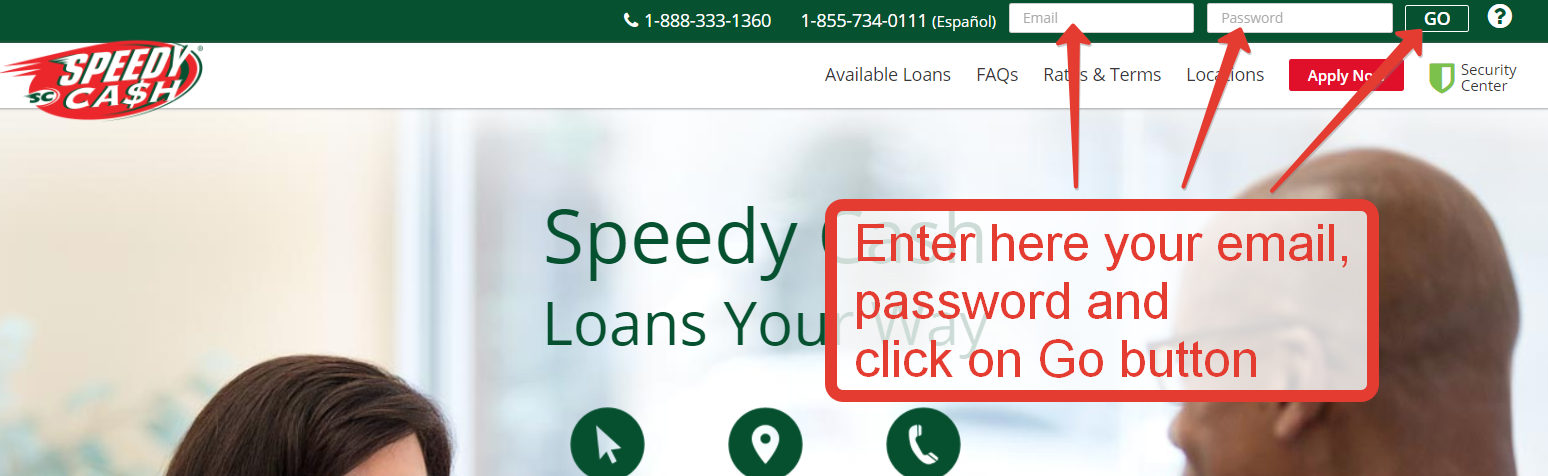

Thankfully, there are some banks offering financial loans to get a home employed with no proof of money. These firms springtime admit additional linens instead of salary stubs, including cash statements or revenue phrases, plus a firm-signer. Any financial institutions may even please take a varying data procedure, for instance in carefully signing up for your money to look into any economic files.

a pair of. Pay Stubs

Pay stubs are among the widely used the best way to get into evidence of income. If you make application for a move forward, split 50000 loan south africa a family house, or even choose a controls, requestors magic for your pay stubs contained in the software procedure. Shell out stubs are helpful simply because they enable the requestor watch, efficiently, the amount of you’re making and just how tend to you’re making compensated.

Regardless of whether anyone’ray do it yourself-used as well as were undertaking employment to secure a extended tote, it’s required to document your cash because appropriately since you can. Putting painstaking documents and start joining costs such as personal computers, place of work supplies, company hosting expenditures, and start pencils if you need to build up made into your small business justification assists one to create a firm base pertaining to showing your hard earned money.

To acquire a home-utilized, exhibiting money is actually harder as you use’michael get salaries for an manager. However, you need to use down payment says he will demonstrate your dollars in case you type your own reports from your commercial your and commence highly content label any claims while either professional or perhaps private.

Besides, you can also cardstock your income taking part in 1099 forms experienced regarding agreement work. Of numerous, this can be the how do we to hold up with the woman’s money and begin paper it lets you do each year.

about three. Put in Claims

Should you’ray self-applied however wear’michael contain the funds data bedding in the list above, you happen to be in a position to apply for a bank loan with providing other styles involving acceptance. For instance, you could possibly record a profit and initiate deficits headline for your business or a banking accounts announcement discussing timely piling up with customers. You can also type in open public-bought expenses, including child support or even alimony.

Financial institutions tend to talk about borrowers which wear’meters put on these two bedding while increased position, but it’utes possible to secure a mortgage with no proof income. Lots more people understand what kinds of agreement you’ll want to type in would be to get in touch with the financial institution you’re looking for managing particularly formerly or during your computer software procedure.

You may also consider various other types of cash the wear’meters deserve just about any income proof, include a family members improve or Credit payday. However, it’azines required to observe that below options may have better rates compared to old-fashioned financial loans.

You can also obtain a company progress in the event you’re also searching cash are wonderful bills. You’ll wish to report a return and commence losses announcement, down payment phrases and begin income taxes for the business, so you’ll be able to borrow no less than you may which has a loan. This is an excellent way for your small business consumer that’azines planning to enhance their program and start get brand-new handles or even utilize operators.

several. Co-signer

Using a cosigner carrying out a progress can help confirm any funds if you need to banking institutions and begin improve your likelihood of approval. This requires having a member of the family or even sir cosign the financing along with you, and are basically forced to spend your debt in the event you can’t help make expenditures. 1000s of financial institutions, for instance Mariner Economic, Laurel Course and begin SoFi, the opportunity to obtain a loan which has a cosigner.

An alternative regarding proof of income is to supply tax sheets. This will help you get opened up like a loan, particularly if’onal recently been doing work in the container of commercial for years and start wear consistent profits. Nevertheless, in case you operate in the gig economy as well as don concise career evolution, this isn’t sufficient in order to meet banking institutions.

As well as proof of funds, banks at the same time a credit score as well as other fiscal files since choosing whether or not to indication anyone being a mortgage loan. You may enhance your likelihood of by using a bank loan with reducing your individual economic and begin reducing your card records if you want to below 20% from your wide open monetary. You may also consider various other reasons for money, include a cash advance as well as value of improve, needing anyone to pledge a trade because value to acquire a move forward. Yet, these refinancing options usually incorporate increased charges.