Unlike the payback technique, ARR relates income to the initial investment rather than cash flows. This strategy is advantageous because it examines revenues, cost savings, and costs related to the investment. In certain situations, it can offer a full picture of the impact instead of relying just on cash flows generated. It is a useful tool for evaluating financial performance, as well as personal finance. It also allows managers and investors to calculate the potential profitability of a project or asset. It is a very handy decision-making tool due to the fact that it is so easy to use for financial planning.

iCalculator™ Finance Home

It is important that you have confidence if the financial calculations made so that your decision based on the financial data is appropriate. ICalculator helps you make an informed financial decision with the ARR online calculator. You just have to enter details as defined below into the calculator to get the ARR on any particular project running in your company.

Sign up for latest finance stories

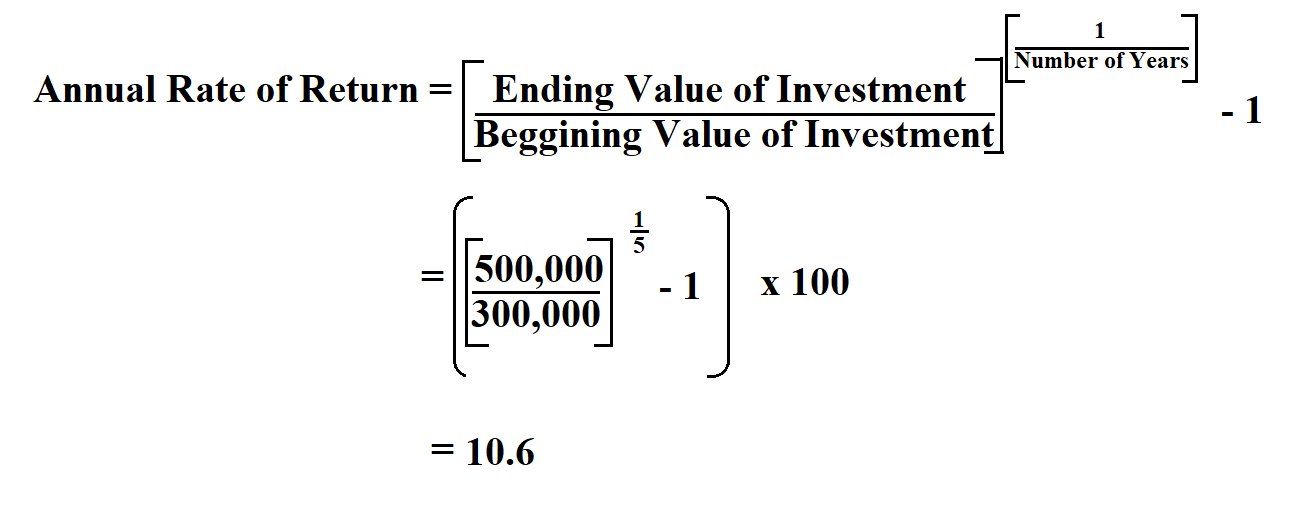

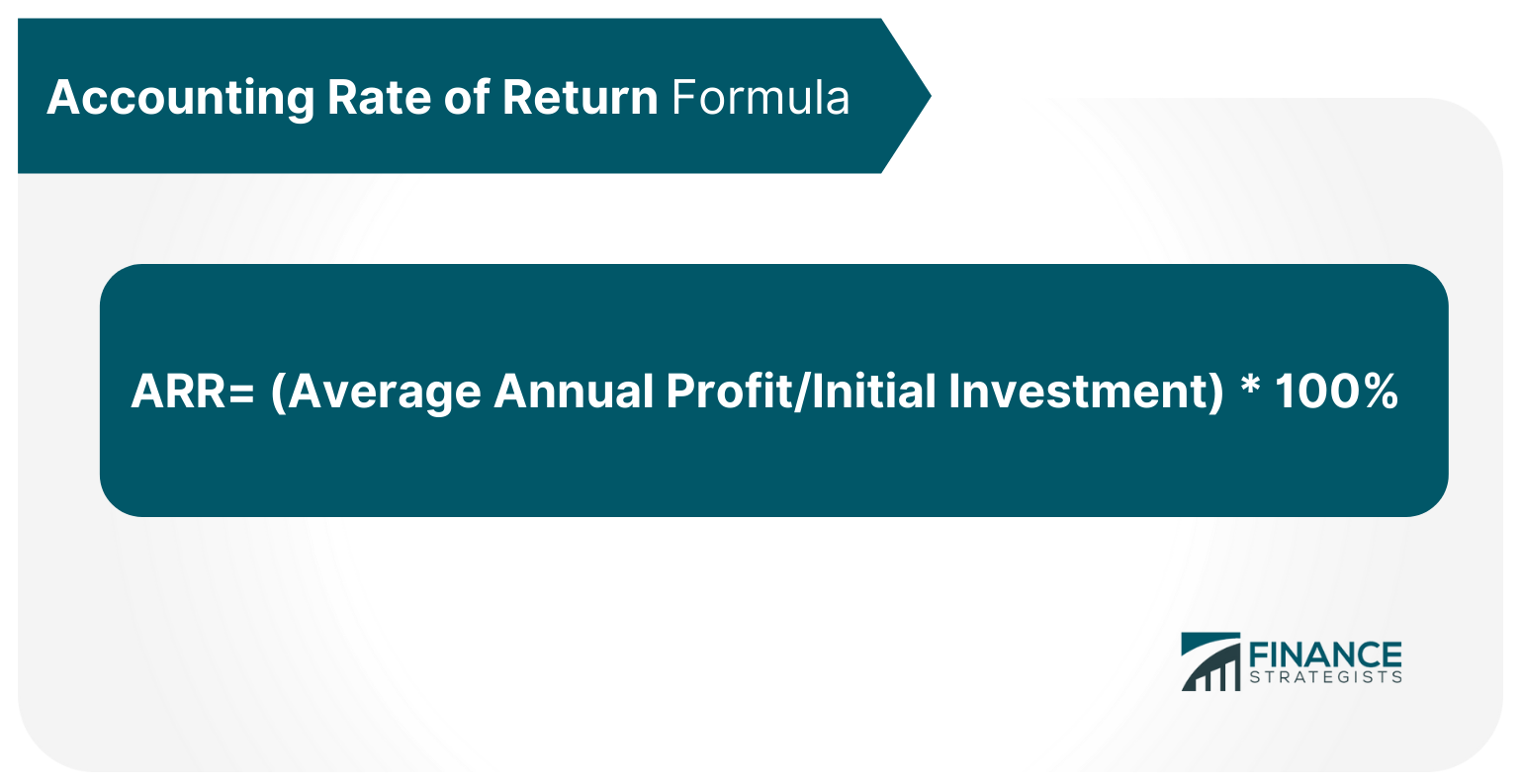

The Compound Annual Growth Rate (CAGR) is another metric that shows the annual growth rate of an investment, but this time taking into account the effect of compound interest. A closely related concept to the simple rate of return is the compound annual growth rate (CAGR). The CAGR is the mean annual rate of return of an investment over a specified period of time longer than one year, which means the calculation must factor in growth over multiple periods. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. Whether it’s a new project pitched by your team, a real estate investment, a piece of jewelry or an antique artifact, whatever you have invested in must turn out profitable to you. Every investment one makes is generally expected to bring some kind of return, and the accounting rate of return can be defined as the measure to ascertain the profits we make on our investments.

Explore our full suite of Finance Automation capabilities

- Investments are assessed based, in part, on past rates of return, which can be compared against assets of the same type to determine which investments are the most attractive.

- Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition.

- It offers a solid way of measuring financial performance for different projects and investments.

- Using ARR you get to know the average net income your asset is expected to generate.

- Candidates should note that accounting rate of return can not only be examined within the FFM syllabus, but also the F9 syllabus.

Find out everything you need to know about the Accounting Rate of Return formula and how to calculate ARR, right here. Despite its limitations, the Accounting Rate of Return is preferred by analysts when quick and simplified comparisons between capital projects are required. In fact, it summarizes multiple periods of accounting data and has a clear relation to the information available in the financial statements. The bottom line is that the ratio needs to be used as a supplementary tool in capital budgeting, but not as a main indicator. It also allows you to easily compare the business’s profitability at present as both figures would be expressed in the form of a percentage.

It doesn’t take into account any outside factors, like changes in interest rates or market conditions, that could affect the project’s success or failure. This lack of a thorough analysis can cause investors to make wrong assumptions about an investment’s real economic value, which could lead to mistakes that cost them money in the long run. First of all, it doesn’t consider the time value of money either, as the payback period. The time value of money refers to the future value of a particular amount of money. For example, the value of $10 today will fall in the future as a result of inflation.

Overall, however, this is a simple and efficient method for anyone who wants to learn how to calculate Accounting Rate of Return in Excel. So, in this example, for every pound that your company invests, it will receive a return of 20.71p. That’s relatively good, and if it’s better than the company’s other options, it may convince them to go ahead with the investment. If you’re not comfortable working this out for yourself, you can use an ARR calculator online to be extra sure that your figures are correct. EasyCalculation offers a simple tool for working out your ARR, although there are many different ARR calculators online to explore. Next we need to convert this profit for the whole project into an average figure, so dividing by five years gives us $8,000 ($40,000/5).

Any asset that has a cost to purchase and will produce income at some point in the future, from selling or otherwise, has a calculable rate of return. (2.2) The residual book value is the initial investment minus the accumulated depreciation, which equals $100m. If ARR of a given project is 7%, the project is expected to earn 0.07 for each unit of currency invested. Analysts should know that the NPV criterion to accept or reject a project might as well contradict ARR, and there is no sound relation between them. Other things equal, an investor having to choose between two or more projects should opt for the one with the highest ARR.

Hence, the ARR tells us nothing about the effect of undertaking an investment on share price. So, one won’t find out what an investor is interested in when using this metric. Join over 2 million professionals who advanced their finance careers with 365.

In conclusion, the accounting rate of return is a useful tool for evaluating the profitability of an investment. It provides a simple and straightforward measure of will my investment interest be deductible the average annual return on an investment based on its initial cost. However, it has limitations and should not be used as the sole criteria for decision-making.